Rob Harper and Land South Group donate 70 head of zebu cattle for Polk County students to learn the ropes of showing steer

EDUCATION IN AGRICULTURE isn’t just about book learning. It’s often more about getting your fingers in the soil, your hands on the tractor wheel, and your arms around livestock. It’s more about experiencing what farmers, ranchers, and growers go through to bring good foods to the marketplace.

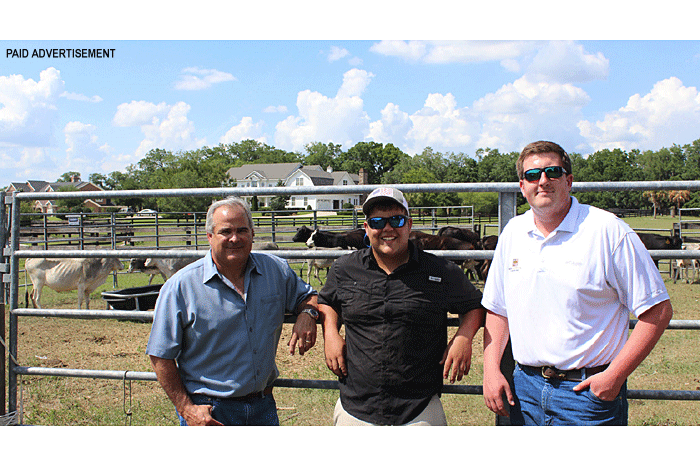

Today, agriculture students in several Polk County high schools have a greater opportunity to learn about cattle raising following a donation of an entire herd of zebu cows. The cows are a gift to ag education from Rob Harper and Lakeland, Florida-based Land South Group, the parent company of AgAmerica Lending.

“This is not only a benefit to schools, but it also supports the community,” says Harper, a managing partner for Land South Group. “Students are given the opportunity to experience cattle first hand.”

The donation involves more than 70 head of cattle with a herd value placed between $100,000 and $125,000. Distribution of the cows to Kathleen High School and other Polk County schools with agriculture programs will be based on each school’s needs, Harper says. “Because zebus are mostly used for breeding purposes, this will give the schools a unique opportunity to start a breeding program for students who otherwise could not afford to show steers,” he adds.

Zebu is a domesticated cattle breed that originated in southern India. Zebus are characterized by a fatty hump between the shoulders, dropping ears and a large dewlap (the fold of loose skin that hangs under the neck). Raised and used for farming in many tropical countries, the zebus can withstand Florida’s hot temperatures.

The average size of the donated zebus is 34 to 37 inches tall and 250 to 400 pounds — about one-third the size of an average beef cow. For agriculture students, that can be a significant benefit.

“Everything is the same as showing a steer or a cow except it’s on a smaller scale, because they (the zebus) are so much smaller. They take less feed, less pasture,” Harper points out. “With cattle and feed prices at all-time highs, showing steer has become too expensive and out of reach for many ag students. Running a zebu operation is nearly the same from an education standpoint, and so much more affordable.”

Harper says zebu meat is often tough and has a relatively poor eating quality, but, he adds, the donated cattle will serve a good and useful purpose under the care of the high school ag instructors and students. “Students can raise the cattle themselves, learning how much work it takes,” he says.

The cattle donation is just another way Land South is working to further ag educational and business opportunities throughout the United States. Through its AgAmerica Lending subsidiary, the company aims to help today’s farmers, growers, and ranchers achieve their dreams.

Staffed by professionals with many years of practical experience in agriculture, real estate, and land appraisal, AgAmerica offers low-interest agricultural loans based on agricultural real estate. Brad Smith, an AgAmerica correspondent lender who grew up in farming and became a farmer himself, says AgAmerica assists the family farmer “by offering great loan rates that save on interest.”

“This results in a larger portion of their hard-earned profits being returned to their business,” he says. “Increased profits are vital to long-term sustainability. This allows the farmer to re-invest more into growing their farming business.

“For example, our 10-year line of credit allows farmers to survive the ups and downs of farming without having to deal with the frustrating and costly process of renewing annually. With banking rules changing as fast as they are, we are able to set up the farmer for the long term and eliminate the yearly worry of their operating lines being renewed.”

Bryce Philpot, AgAmerica’s head of underwriting, says the company’s loans cover all facets of farming — from smaller blueberry farms to vast tomato fields, from citrus groves to cattle ranches. When it’s time to plant the next row crop, make a transition from citrus to peaches, plant timber, or start buying more cattle, these loans are a great choice.

Why should growers and farmers look to AgAmerica for agricultural loans? Philpot says the company’s 10-year, interest-only revolving line of credit is advantageous for several reasons:

• It’s an operating line that can be used for funding operations, purchases, or refinancing.

• The interest rate currently is less than 3 percent.

• There are no prepayment penalties.

• No “resting period” is required.

• There are no annual paperwork renewals.

“Once you’re approved with AgAmerica, you’re set for 10 years without the hassle of redoing paperwork every year,” Philpot says. “And, unlike other ag lenders, we can offer 25-year amortizations, which keep annual term payments low.”

AgAmerica is a wholly owned subsidiary of Land South Group (landsouthgroup.com). For more information, including details about AgAmerica Lending programs, call 1-855-898-2265 or go online to www.AgAmerica.com.

This article is sponsored by AgAmerica Lending and Land South Group.